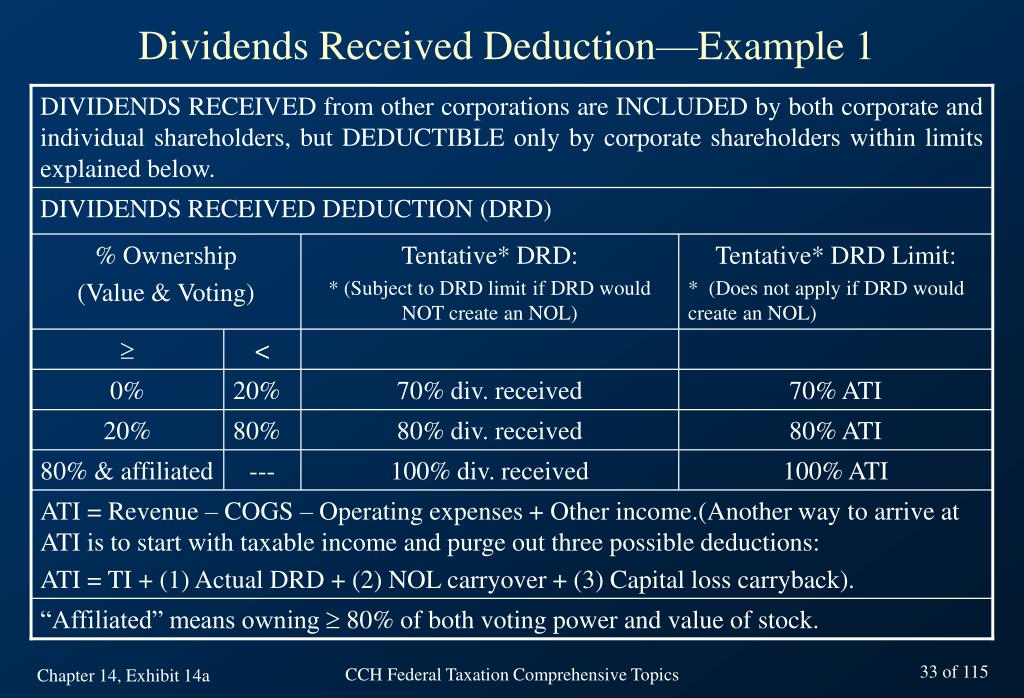

How Are Corporations Taxed On Dividends Received . However, they may also pay them as stock of another corporation or as any other. (a) general rule in the case of a corporation, there shall be allowed as a deduction an amount equal to the following percentages. a corporation can deduct a percentage of certain dividends received during its tax year. This section discusses the general. corporations pay most dividends in cash. the dividends received deduction, or drd, is a tax deduction that c corporations receive on the dividends. It allows corporations to deduct a portion of the dividend. shareholders recognize a taxable dividend to the extent a distribution is paid out of corporate earnings and profits. The drd’s main purpose is to protect corporations from being subject to triple taxation. the dividends received deduction (drd) is a u.s.

from www.slideserve.com

However, they may also pay them as stock of another corporation or as any other. This section discusses the general. shareholders recognize a taxable dividend to the extent a distribution is paid out of corporate earnings and profits. The drd’s main purpose is to protect corporations from being subject to triple taxation. It allows corporations to deduct a portion of the dividend. a corporation can deduct a percentage of certain dividends received during its tax year. the dividends received deduction, or drd, is a tax deduction that c corporations receive on the dividends. (a) general rule in the case of a corporation, there shall be allowed as a deduction an amount equal to the following percentages. corporations pay most dividends in cash. the dividends received deduction (drd) is a u.s.

PPT Chapter 14 Taxation of Corporations —Basic Concepts PowerPoint Presentation ID458382

How Are Corporations Taxed On Dividends Received The drd’s main purpose is to protect corporations from being subject to triple taxation. a corporation can deduct a percentage of certain dividends received during its tax year. (a) general rule in the case of a corporation, there shall be allowed as a deduction an amount equal to the following percentages. However, they may also pay them as stock of another corporation or as any other. corporations pay most dividends in cash. The drd’s main purpose is to protect corporations from being subject to triple taxation. the dividends received deduction (drd) is a u.s. This section discusses the general. shareholders recognize a taxable dividend to the extent a distribution is paid out of corporate earnings and profits. the dividends received deduction, or drd, is a tax deduction that c corporations receive on the dividends. It allows corporations to deduct a portion of the dividend.

From blog.fiducial.com

Is Your Corporation Eligible for the DividendsReceived Deduction? How Are Corporations Taxed On Dividends Received the dividends received deduction (drd) is a u.s. It allows corporations to deduct a portion of the dividend. the dividends received deduction, or drd, is a tax deduction that c corporations receive on the dividends. corporations pay most dividends in cash. a corporation can deduct a percentage of certain dividends received during its tax year. This. How Are Corporations Taxed On Dividends Received.

From www.slideserve.com

PPT Chapter 14 Taxation of Corporations —Basic Concepts PowerPoint Presentation ID458382 How Are Corporations Taxed On Dividends Received This section discusses the general. a corporation can deduct a percentage of certain dividends received during its tax year. However, they may also pay them as stock of another corporation or as any other. (a) general rule in the case of a corporation, there shall be allowed as a deduction an amount equal to the following percentages. . How Are Corporations Taxed On Dividends Received.

From www.slideserve.com

PPT Chapter 2 PowerPoint Presentation, free download ID5827456 How Are Corporations Taxed On Dividends Received This section discusses the general. (a) general rule in the case of a corporation, there shall be allowed as a deduction an amount equal to the following percentages. the dividends received deduction (drd) is a u.s. However, they may also pay them as stock of another corporation or as any other. The drd’s main purpose is to protect. How Are Corporations Taxed On Dividends Received.

From cheap-accountants-in-london.co.uk

How Do Dividends Work In The UK? A Basic Guide How Are Corporations Taxed On Dividends Received the dividends received deduction, or drd, is a tax deduction that c corporations receive on the dividends. shareholders recognize a taxable dividend to the extent a distribution is paid out of corporate earnings and profits. It allows corporations to deduct a portion of the dividend. This section discusses the general. The drd’s main purpose is to protect corporations. How Are Corporations Taxed On Dividends Received.

From blog.fiducial.com

Is Your Corporation Eligible for the DividendsReceived Deduction? How Are Corporations Taxed On Dividends Received The drd’s main purpose is to protect corporations from being subject to triple taxation. However, they may also pay them as stock of another corporation or as any other. the dividends received deduction, or drd, is a tax deduction that c corporations receive on the dividends. This section discusses the general. corporations pay most dividends in cash. It. How Are Corporations Taxed On Dividends Received.

From www.chegg.com

Solved Corporate Corporations earn most of their from How Are Corporations Taxed On Dividends Received It allows corporations to deduct a portion of the dividend. The drd’s main purpose is to protect corporations from being subject to triple taxation. This section discusses the general. the dividends received deduction, or drd, is a tax deduction that c corporations receive on the dividends. corporations pay most dividends in cash. a corporation can deduct a. How Are Corporations Taxed On Dividends Received.

From slideplayer.com

to Federal Tax Business Entities ACNT 1347 Course Atef Abuelaish. ppt download How Are Corporations Taxed On Dividends Received This section discusses the general. (a) general rule in the case of a corporation, there shall be allowed as a deduction an amount equal to the following percentages. It allows corporations to deduct a portion of the dividend. The drd’s main purpose is to protect corporations from being subject to triple taxation. the dividends received deduction, or drd,. How Are Corporations Taxed On Dividends Received.

From www.aghlc.com

Is your corporation eligible for the dividendsreceived deduction? How Are Corporations Taxed On Dividends Received corporations pay most dividends in cash. This section discusses the general. (a) general rule in the case of a corporation, there shall be allowed as a deduction an amount equal to the following percentages. The drd’s main purpose is to protect corporations from being subject to triple taxation. the dividends received deduction (drd) is a u.s. . How Are Corporations Taxed On Dividends Received.

From www.slideserve.com

PPT Chapter PowerPoint Presentation, free download ID542595 How Are Corporations Taxed On Dividends Received However, they may also pay them as stock of another corporation or as any other. corporations pay most dividends in cash. This section discusses the general. shareholders recognize a taxable dividend to the extent a distribution is paid out of corporate earnings and profits. the dividends received deduction (drd) is a u.s. a corporation can deduct. How Are Corporations Taxed On Dividends Received.

From www.chegg.com

Solved DividendsReceived Deduction (LO. 1) The John How Are Corporations Taxed On Dividends Received shareholders recognize a taxable dividend to the extent a distribution is paid out of corporate earnings and profits. corporations pay most dividends in cash. This section discusses the general. However, they may also pay them as stock of another corporation or as any other. the dividends received deduction (drd) is a u.s. (a) general rule in. How Are Corporations Taxed On Dividends Received.

From www.avalonaccounting.ca

Actual Dividends vs. Taxable Dividends Blog Avalon Accounting How Are Corporations Taxed On Dividends Received corporations pay most dividends in cash. the dividends received deduction (drd) is a u.s. (a) general rule in the case of a corporation, there shall be allowed as a deduction an amount equal to the following percentages. shareholders recognize a taxable dividend to the extent a distribution is paid out of corporate earnings and profits. However,. How Are Corporations Taxed On Dividends Received.

From slideplayer.com

The Corporate Taxpayer ppt download How Are Corporations Taxed On Dividends Received the dividends received deduction, or drd, is a tax deduction that c corporations receive on the dividends. (a) general rule in the case of a corporation, there shall be allowed as a deduction an amount equal to the following percentages. It allows corporations to deduct a portion of the dividend. the dividends received deduction (drd) is a. How Are Corporations Taxed On Dividends Received.

From www.slideserve.com

PPT Chapter 14 Taxation of Corporations —Basic Concepts PowerPoint Presentation ID458382 How Are Corporations Taxed On Dividends Received However, they may also pay them as stock of another corporation or as any other. (a) general rule in the case of a corporation, there shall be allowed as a deduction an amount equal to the following percentages. the dividends received deduction, or drd, is a tax deduction that c corporations receive on the dividends. This section discusses. How Are Corporations Taxed On Dividends Received.

From www.slideserve.com

PPT Chapter 11 Corporate Tax PowerPoint Presentation, free download ID4223167 How Are Corporations Taxed On Dividends Received (a) general rule in the case of a corporation, there shall be allowed as a deduction an amount equal to the following percentages. It allows corporations to deduct a portion of the dividend. The drd’s main purpose is to protect corporations from being subject to triple taxation. the dividends received deduction (drd) is a u.s. This section discusses. How Are Corporations Taxed On Dividends Received.

From www.chegg.com

Solved This year, GHJ Inc. received the following dividends. How Are Corporations Taxed On Dividends Received shareholders recognize a taxable dividend to the extent a distribution is paid out of corporate earnings and profits. the dividends received deduction, or drd, is a tax deduction that c corporations receive on the dividends. a corporation can deduct a percentage of certain dividends received during its tax year. corporations pay most dividends in cash. However,. How Are Corporations Taxed On Dividends Received.

From www.artofit.org

What are s corporation dividends and how are they taxed Artofit How Are Corporations Taxed On Dividends Received (a) general rule in the case of a corporation, there shall be allowed as a deduction an amount equal to the following percentages. However, they may also pay them as stock of another corporation or as any other. shareholders recognize a taxable dividend to the extent a distribution is paid out of corporate earnings and profits. corporations. How Are Corporations Taxed On Dividends Received.

From amynorthardcpa.com

What Are SCorporation Dividends and How Are They Taxed? How Are Corporations Taxed On Dividends Received (a) general rule in the case of a corporation, there shall be allowed as a deduction an amount equal to the following percentages. However, they may also pay them as stock of another corporation or as any other. the dividends received deduction (drd) is a u.s. This section discusses the general. The drd’s main purpose is to protect. How Are Corporations Taxed On Dividends Received.

From www.gtaaccounting.ca

How Corporations are Taxed on Dividends Received How Are Corporations Taxed On Dividends Received a corporation can deduct a percentage of certain dividends received during its tax year. This section discusses the general. the dividends received deduction, or drd, is a tax deduction that c corporations receive on the dividends. (a) general rule in the case of a corporation, there shall be allowed as a deduction an amount equal to the. How Are Corporations Taxed On Dividends Received.